How to Perform a Lease Classification Test

Last Updated on May 23, 2025 by

After collecting and organizing your organization’s contracts, you’ll want to determine if each individual contract is a finance or an operating lease. In order to do this you’ll use the lease classification test.

What is a Lease Classification Test?

With ASC 840, capital leases were accounted for on the balance sheet. In comparing ASC 840 to ASC 842, the biggest change is the addition of operating leases on the balance sheet and the name change from capital to finances leases. How do you determine if a lease is an operating lease or a finance lease? Well, that is where the lease classification test comes into play.

As a guiding principle, if the majority of the assets life is controlled by the lessee, then it should be classified as a finance lease. If not, then it is an operating lease.

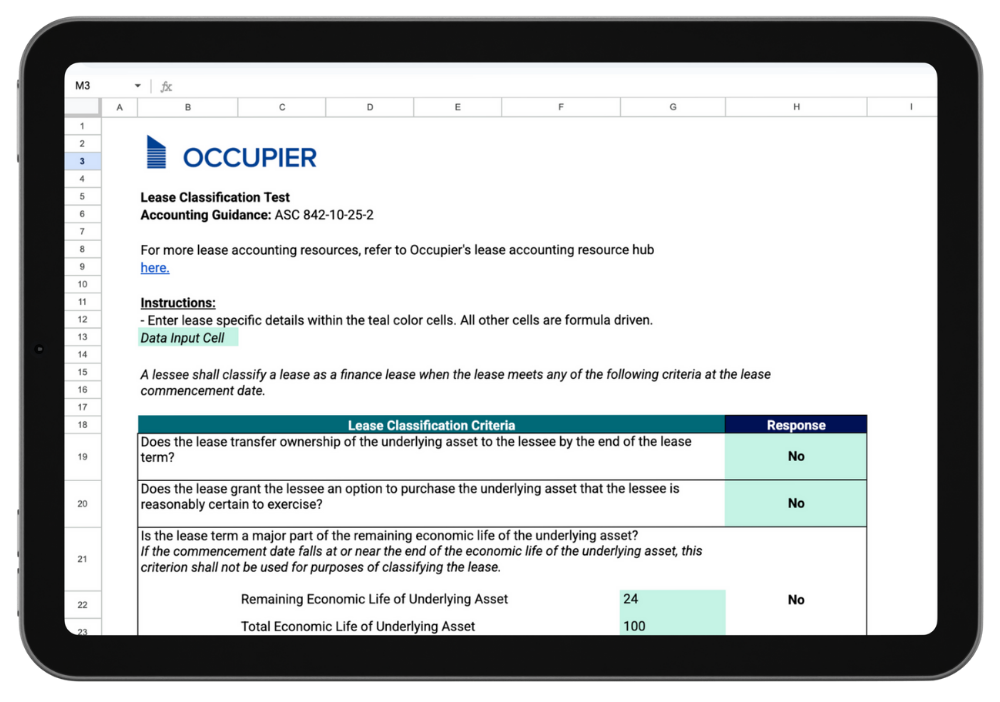

Download our Lease Classification Test – Excel Template below!

Criteria to determine the lease classification

A lessee shall classify a lease as a finance lease when the lease meets any of the following criteria at the lease commencement date:

Transfer of Ownership –

If the lease transfers ownership of the underlying asset to the lessee by the end of the lease term then it is a finance lease. For this criterion to be met, the title must be transferred at little or no cost to the lessee shortly after the end of the lease term. If paying the fee (even when the fee is nominal) is optional, the lease would not explicitly meet this criterion but would still be evaluated under the option to purchase criterion below.

Option to Purchase –

If the lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise then it is a finance lease. “Reasonably certain” is meant to be a high threshold and is a higher threshold than “probable” under ASC 450. ASC 842 includes certain factors a lessee should evaluate when determining whether the exercise of a purchase option is reasonably certain, including contract-based, asset-based, entity-based, and market-based factors. Generally speaking, after considering these factors, the lessee should evaluate whether it has an economic compulsion or incentive to exercise its purchase option since this is a strong indicator that exercise of the option is reasonably certain.

The Lease Term & Economic Life of Said Asset –

If the underlying asset endures a major part of its economic life during the lease term then it is a finance lease. However, if the lease commencement date falls at or near the end of the economic life of the underlying asset, this criterion shall not be used for purposes of classifying the lease. Although ASC 842 does not have any bright lines when determining lease classification, one reasonable approach to assessing the criteria in paragraphs would be to conclude:

- 75% or more of the remaining economic life of the underlying asset is a major part of the remaining economic life of that underlying asset.

- A commencement date that falls at or near the end of the economic life of the underlying asset refers to a commencement date that falls within the last 25% of the total economic life of the underlying asset.

The Present Value Exceeds the Fair Value –

It is a finance lease as long as the present value of the sum of the lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments exceeds:

- 90% or more of the fair value of the underlying asset amounts to substantially all of the fair value of the underlying asset.

- Residual Value Guarantees: There is a significant difference between residual guarantees related to determining lease payments for lease measurement purposes and those related to evaluating lease classification. For lease payments, a lessee would only include the probable amount.

Specialized Asset –

If that is the case and it is expected to have no alternative use to the lessor at the end of the lease term then it is a finance lease. The basis for this determination is that when an underlying asset has no alternative use to the lessor at the end of a lease term, it is presumed that the lessee will consume all (or substantially all) of the benefits of the asset. If an entity decides to apply the bright-line thresholds in ASC 840 when classifying a lease, the entity will apply those thresholds consistently to all of its leases.

Lease Accounting Differences between ASC 842 and IFRS 16

The model outlined above discusses the lease classification criteria for a lessee under ASC 842. FASB created the dual model approach above the break leases into two categories, either a finance lease or an operating lease. Although both FASB and IASB collaborated to create their guidelines, ASC 842 and IFRS 16, they do diverge in their requirements. IASB created a single model approach in which leases under IFRS are generally accounted for as finance leases.

Under IFRS 16, two exceptions can be applied in order to exclude leases from the balance sheet.

- Short-term leases – Both FASB and IASB consider short-term leases any contract in which the lease term is 12-months or less.

- Low value leases – IFRS 16 indicated that lessees can elect not to recognize a ROU asset and lease liability for any lease in which the underlying asset meets the low value threshold. While the low value is not explicitly stated, it is mentioned in the Basis for Conclusion of IFRS 16, citing the amount of $5,000 or less.

We hope this information is useful as you navigate your lease classification journey via the ASC 842 and/ or IFRS standards. Download our Occupier Lease Accounting Classification Test to help you classify your organization’s contracts.

Accounting Guidance Referenced:

- ASC 842-10-25-2

- ASC 842-10-25-2(c) through (d)

- ASC 842-10-25-3(b)(1)

- Deloitte A Roadmap to Applying the New Leasing Standard (2020) 8.3.3.3- 8.3.3.7

Check out our Lease Accounting Compliance Hub for all things ASC 842.