Breaking Down Lease Accounting Journal Entries

Last Updated on June 6, 2024 by Morgan Beard

Lease accounting journal entries are an essential aspect of maintaining accurate financial reporting and compliance with accounting standards. For commercial tenants, CPAs, and accounting & finance teams, creation of your journal entries are a month-end task.

Understanding the lease accounting journal entries involves three key steps: initial recognition and measurement, subsequent adjustments for lease payments, and interest/amortization entries. We will dive into these intricacies so that creation of your lease accounting journal entries is vital for accurate financial reporting and compliance.

The Importance of Lease Accounting Journal Entries

Before diving into the specifics, let’s first understand why lease accounting journal entries are so important. When companies lease assets, such as office spaces or equipment, they are required to record these transactions accurately in their financial statements. Lease accounting journal entries help companies track and report these lease arrangements, ensuring compliance with accounting standards such as the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). These new lease accounting standards provide a company with a true understanding of their financial position, their operating cash flow and the financial impact of their lease portfolio.

Key Concepts in Lease Accounting

To comprehend lease accounting journal entries fully, it is essential to grasp some key concepts:

1. Lease Classification

Leases can be classified into two main types: operating leases and finance leases. Operating leases are typically lease contracts where the lessor retains ownership of the asset and the lessee operates the asset. While finance leases are long-term agreements where the lessee assumes ownership of the asset at the end of the lease term. Understanding the classification of leases is crucial as it determines how lease payments are recorded in the financial statements.

2. Lease Term

The lease term refers to the duration in which the lessee has the right to use the leased asset. It includes both the initial lease term and any additional periods that are reasonably certain to be exercised, such as renewal options.

3. Lease Payments

Lease payments include fixed payments, variable payments based on usage, and any other costs explicitly specified in the lease agreement. Expenses included in lease payments often include base rent, any additional rent like utilities, CAM, insurance, property taxes etc. Depending on the lease type, lease payments may need to be allocated between the lease liability and the right-of-use asset.

4. Discount Rate

The discount rate is the interest rate used to calculate the present value of future lease payments. It is typically the lessee’s incremental borrowing rate unless the rate implicit in the lease is readily determinable.

Lease Accounting Journal Entries

Now that we have a foundation of lease accounting concepts, let’s explore the journal entries involved in lease accounting.

1. Initial Recognition

The initial recognition of a lease is a crucial step that involves recording both the lease liability and the corresponding right-of-use (ROU) asset on the lessee’s balance sheet.

- The lease liability is measured at the present value of future lease payments, discounted using the rate implicit in the lease or the lessee’s incremental borrowing rate.

- The ROU asset, on the other hand, is initially measured at the amount of the lease liability, adjusted for any prepaid or accrued lease payments, initial direct costs, and lease incentives received.

This dual recognition reflects the lessee’s obligation to make future lease payments and their right to use the underlying asset during the lease term. Proper initial recognition ensures transparency and provides stakeholders with a comprehensive view of the company’s lease commitments and related assets.

2. Subsequent Measurement – Lessee

After the initial recognition, the lessee needs to account for the lease liability and the right-of-use asset during the lease term. This involves recognizing interest expenses on the lease liability and depreciating the right-of-use asset.

3. Lease Modifications

Lease modifications occur when there are changes to the lease agreement, such as modifications to the lease term or lease payments. When a lease modification occurs, the lessee needs to account for the change in the lease liability and the right-of-use asset. Here are the journal entries for lease modifications:

4. Lease Termination

When a lease is terminated before its original end date, the lessee needs to account for the lease liability and the right-of-use asset accordingly. Here are the journal entries for lease termination:

Operating Lease Journal Entry Example

When it comes to operating leases, the lessee recognizes lease payments as an operating expense on a straight-line basis over each period or the lease term.

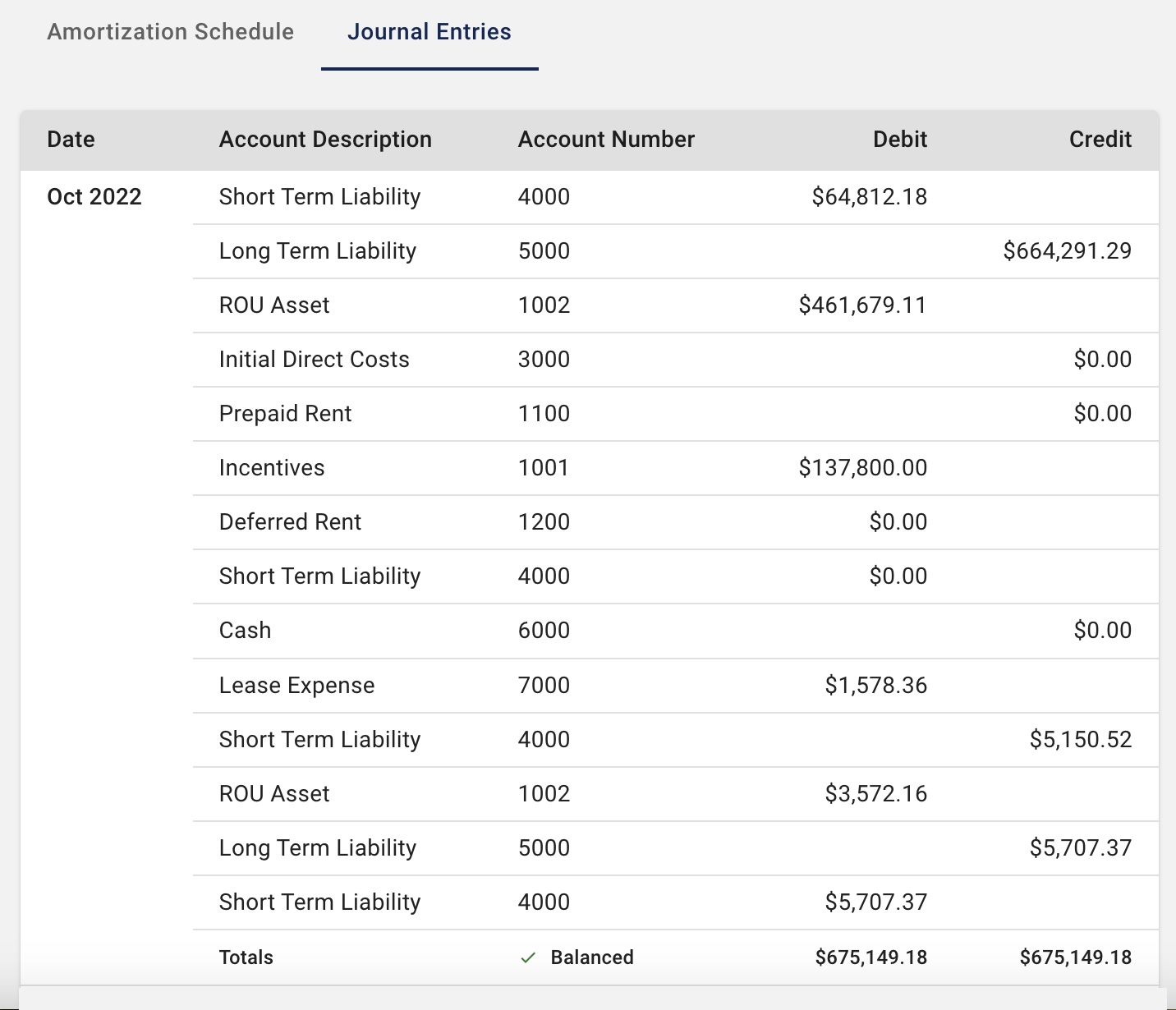

Upon the lease commencement date of an operating lease, the following journal entries are typically recorded:

- Short Term Lease Liability: The portion of the total lease obligation due within the next 12 months, segregated for GAAP compliance.

- Long Term Lease Liability: The remaining lease obligation beyond the next 12 months, reduced by periodic lease payments.

- ROU Asset Reduction: The straight-line amortization of the ROU asset over the lease term/useful life, minus the current period’s interest expense on the lease liability.

- Initial Direct Costs: These are incremental costs directly attributable to negotiating and arranging a lease agreement, such as commissions or legal fees. They are added to the initial measurement of the lease liability and Right-of-Use asset.

- Prepaid Rent: Rent payments made in advance to the lessor before the commencement of the lease term are classified as prepaid rent. These amounts are recorded as an asset and amortized over the lease term.

- Incentives: Lease incentives, such as rent holidays or tenant improvement allowances provided by the lessor, reduce the total consideration paid by the lessee over the lease term. These incentives are deducted from the initial measurement of the lease liability and Right-of-Use asset.

- Cash: Lease Payment

- Operating Lease Expense: Under ASC 842, operating lease expense is calculated by dividing the total lease payments by the ROU asset’s useful life or lease term, rather than directly matching the cash payment in a given period.

The Importance of Lease Accounting Journal Entries

Navigating the nuances of lease accounting journal entries is crucial for maintaining accurate financial reporting and compliance with accounting standards. Whether dealing with operating leases or capital/finance leases, it’s essential for finance professionals to have a solid understanding of the proper journal entries and their implications. By adhering to the appropriate accounting practices and leveraging lease accounting software solutions, companies can ensure transparent and reliable financial reporting while staying up-to-date with the latest lease accounting changes.

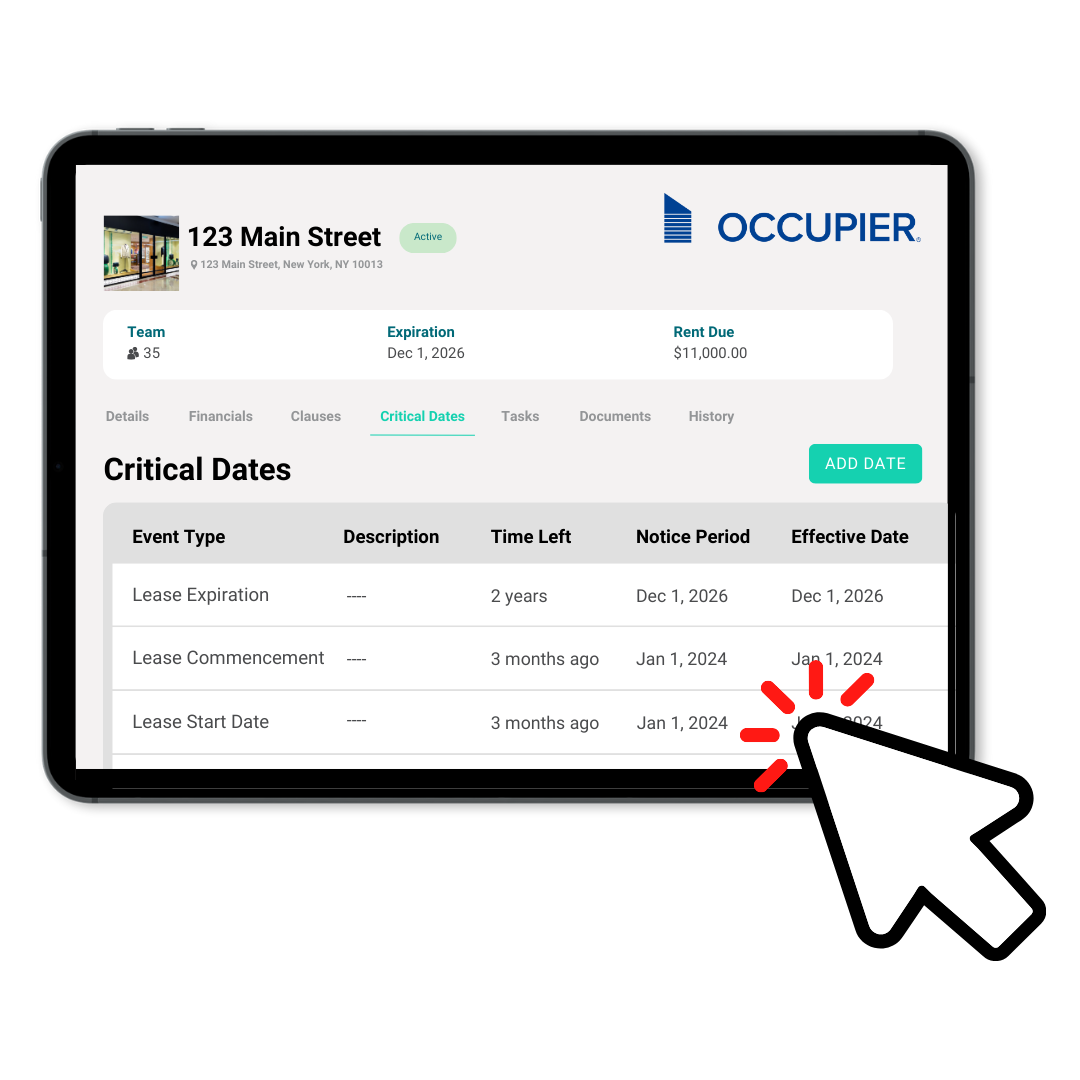

Product Tour

Take a self-guided tour and see how the fastest-growing commercial tenants leverage Occupier for lease management & lease accounting.